In this thought provoking piece, we delve into the transformative trends reshaping the meat industry, highlighted by the adoption of sustainable practices, technological advancements, and shifting consumer preferences. The piece emphasizes the crucial need for strategic adaptation and innovation among meat producers to address the dual challenges of environmental sustainability and changing market demands. As a global enabler and management consulting firm, Hylman is ideally positioned to support companies in navigating this complex landscape. Hylman's expertise in strategic planning, technological integration, and sustainability initiatives makes it an invaluable partner for companies seeking to capitalize on emerging opportunities and drive forward-thinking solutions in the meat industry.

The meat industry stands as a colossal and pivotal sector within the global economy, deeply embedded in cultural, economic, and ethical spheres. As of 2024, it is undergoing a transformative shift that promises to redefine not only how meat is produced and consumed but also how it impacts the planet. This industry, historically rooted in age-old practices, is now on the forefront of some of the most cutting-edge technological advancements in biotechnology and artificial intelligence.

With the world’s population projected to approach 10 billion by 2050, the demand for protein continues to surge, placing unprecedented pressures on meat producers to innovate while simultaneously mitigating their environmental footprint. Consumer trends are rapidly evolving; a growing number of global consumers are now demanding not only high-quality and affordable products but also transparency regarding the ethical treatment of animals and the sustainability of production processes.

Moreover, the rise of alternative proteins suggests a significant pivot towards more sustainable consumption practices. The burgeoning interest in plant-based and cultured meat products is not merely a trend but a movement, reflecting a shift in consumer consciousness that is reshaping the industry’s landscape. Companies within this sector are thus compelled to navigate these complex changes, balancing profitability with sustainability in an effort to not only thrive but also positively influence global food security and environmental sustainability.

This intricate dance between tradition and innovation, between current practices and future possibilities, makes the meat industry a fascinating mirror reflecting broader societal values and economic pressures at play today. How the industry evolves from here could have far-reaching consequences for food culture worldwide, the global economy, and the planet’s ecological balance. As we delve deeper into this critical juncture, the stakes are high, and the opportunities are vast, making this a pivotal moment for one of the most foundational sectors of our time.

Latest trends and innovations

Today, the meat industry is experiencing significant transformation driven by technological advancements and consumer demands for sustainability and traceability. One of the most prominent trends is the adoption of precision livestock farming. This approach utilizes advanced technologies such as IoT sensors, AI, and data analytics to monitor animal health and optimize feed efficiency. For example, companies like Connecterra have developed AI-driven platforms that analyze behavior patterns to predict and improve dairy cow health, which not only boosts productivity but also enhances animal welfare. Such technologies are proving vital in reducing the ecological footprint of meat production, by minimizing waste and improving resource management.

Simultaneously, the push towards sustainability has accelerated the development of cultured meat. Start-ups like Mosa Meat and Memphis Meats are at the forefront of this innovation, having significantly reduced the cost of production by about 80% since 2019. The price per kilogram of cultured meat, once costing over $1,000, is projected to fall to commercial viability levels under $50 by 2025. These advancements are crucial as they promise a future where meat production is decoupled from traditional agriculture, thereby reducing land use, water consumption, and greenhouse gas emissions.

Blockchain technology is another area where the meat industry sees substantial innovation. It is increasingly used to ensure traceability and transparency throughout the supply chain. Companies like Cargill have implemented blockchain systems that allow consumers to trace the origin of their meat products back to the farm of origin. This not only enhances consumer trust but also streamlines recall processes and improves food safety.

Another innovative trend is the integration of genetic editing technologies, like CRISPR, to enhance livestock traits such as disease resistance and feed efficiency. For instance, in 2024, researchers in the United States and Brazil are collaborating on projects aimed at developing cattle breeds that are more adaptable to varying climatic conditions, which is crucial in the face of global climate change.

Opportunities in the industry

One of the most prominent opportunities is the burgeoning market for plant-based and cultured meat products, which is not merely an alternative niche but increasingly mainstream. As of 2024, the global market for plant-based meat alternatives is projected to grow at a CAGR of 15% over the next five years, reflecting not only a shift in consumer preferences but also an increased awareness of health and environmental impacts. This market expansion is facilitated by improvements in the textural and flavor qualities of these products, making them more appealing to a broader audience.

Furthermore, the integration of biotechnology in meat production, particularly through gene editing and improvements in animal feed, presents substantial opportunities for efficiency gains. For instance, biotech firms have developed microbial feed additives that enhance the gut health of livestock and improve feed conversion ratios, which can reduce costs and improve the sustainability of meat production. These innovations are not only improving productivity but are also helping address some of the environmental concerns associated with meat production, such as methane emissions from cattle.

Another significant opportunity lies in the export markets, especially in Asia where the demand for high-quality meat products continues to rise due to growing middle-class populations and increased spending power. For example, beef exports from the United States to China have seen a 20% increase in volume in the first half of 2024 compared to the previous year, driven by the Chinese market’s demand for premium meat products. This demand provides lucrative opportunities for meat producers in North America and Europe to expand their market presence.

Additionally, advancements in supply chain management, facilitated by digital technologies such as IoT and blockchain, offer meat producers the opportunity to enhance traceability and efficiency. These technologies help in creating more resilient supply chains by providing real-time data on the movement of goods and conditions of storage, thereby reducing spoilage and ensuring compliance with safety standards. This not only helps in reducing operational costs but also builds consumer trust by ensuring product integrity from farm to table.

The adaptation to regulatory changes also presents a strategic opportunity. As governments worldwide impose stricter regulations on animal welfare, antibiotic use, and environmental impact, there is a significant push within the industry to comply with these new standards. Proactive adaptation to these regulations can serve as a market differentiator, allowing companies to position themselves as industry leaders in ethical meat production. For example, companies that have early adopted non-antibiotic rearing practices have reported a 5% increase in consumer trust ratings, translating into higher product loyalty and pricing power.

The growing interest in customized meat products tailored to specific dietary needs and preferences is opening new market segments. The development of high-protein, low-fat, or enriched with specific nutrients (like omega-3 fatty acids) meat products caters to the health-conscious consumer and can command premium pricing.

Trends and opportunties across sectors

In the agricultural sector, precision farming is revolutionizing how livestock is managed. Farmers now deploy drones and satellite imaging to monitor pasture health and use AI-driven analytics to optimize feed compositions based on the nutritional needs of different animal groups. These technologies not only improve the efficiency of meat production but also enhance animal welfare by providing more timely and precise care. Such practices contribute to a reduction in the carbon footprint of livestock farming, a critical factor given the global push towards sustainability. For instance, the adoption of sensor-based technologies has enabled farmers to reduce feed waste by an estimated 20% in 2024, highlighting significant cost savings and environmental benefits.

Biotechnology intersects with the meat industry through genetic engineering and cellular agriculture, particularly in the development of cultured meat. This sector is witnessing significant investments, with venture capital funding in cultured meat startups surpassing $500 million in the first half of 2024 alone. The biotech sector is not only improving the scalability of cultured meat production but is also enhancing the nutritional profiles of these products, such as by enriching them with essential amino acids and vitamins that are sometimes less prevalent in traditionally farmed meat.

The retail and food service sectors are adapting to these innovations by modifying their supply chains and product offerings. Supermarkets and restaurants are increasingly featuring plant-based and lab-grown meat alternatives alongside traditional meat products. This expansion caters to a diversifying consumer palate interested in exploring sustainable and ethical food options. Retail data from 2024 indicate a 30% increase in shelf space allocated to alternative meat products in major U.S. supermarket chains, reflecting strong consumer interest and the retailers’ strategic response to these evolving market dynamics.

Furthermore, the integration of consumer electronics into the meat industry is enhancing the consumer purchasing experience. Smart refrigerators that can track product expiry dates and suggest recipes based on the meat products available in the fridge are becoming more common. Additionally, smart cooking appliances that guide users through cooking processes and adjust settings automatically to ensure optimal preparation of different types of meats are gaining popularity. These innovations enhance consumer convenience and are driving the demand for premium meat products that are specifically suited for these modern cooking technologies.

The packaging industry also plays a crucial role, with developments in smart packaging that includes sensors to monitor freshness and display information about the meat's origin, feed, and processing history directly to consumers via smartphone apps. This not only bolsters consumer trust but also supports compliance with increasingly stringent food safety regulations.

The increasing public focus on health and wellness has brought the meat industry closer to healthcare. Nutraceuticals, which bridge the gap between food and pharmaceutical products, are on the rise. Meat products enhanced with added health benefits, such as omega-3 fatty acids, vitamins, and probiotics, are gaining traction. For example, products like omega-3-enriched beef are marketed not just on flavor but on their cardiovascular and cognitive health benefits. The development of these products often involves collaboration between meat producers and biotech companies that specialize in biofortification and food sciences. This trend is supported by a growing body of research linking diet with long-term health outcomes, encouraging meat producers to invest in clinical trials to substantiate health claims, thus building credibility and market share in a health-conscious consumer market.

As the global dialogue on climate change intensifies, the meat industry is increasingly intertwined with environmental technology. Innovations such as methane-reducing feed additives are crucial. These additives, developed through biotechnological research, can reduce methane emissions from cattle by up to 30%, directly addressing one of the significant environmental impacts of meat production. Additionally, the industry is adopting renewable energy sources in production processes to decrease the overall carbon footprint. For instance, several large processing plants in the United States and Europe have transitioned to solar and wind energy in 2024, aiming for a reduction in carbon emissions by 25% by 2030 compared to 2020 levels.

The logistics sector plays a critical role in the efficiency and sustainability of the meat industry. With the rise of global meat demand, especially in urban areas, there is a significant push towards optimizing the cold chain logistics to reduce spoilage and improve the delivery speed of fresh products. Innovations like IoT-enabled fleet tracking and temperature-controlled RFID tags ensure that meat products are maintained at optimal conditions throughout transit, greatly reducing the risk of spoilage and ensuring compliance with food safety standards. Advanced analytics and machine learning are also being employed to predict demand more accurately, optimize routing, and manage inventory more efficiently, thereby minimizing waste and reducing costs.

With increasing consumer awareness and stricter regulatory environments, there is a pressing need for the meat industry to prioritize food safety and compliance. The integration of blockchain technology provides a robust solution for traceability and transparency, enabling companies to track every step of the meat's journey from farm to table. This technology not only helps in quickly pinpointing issues in the event of a food safety recall but also enhances consumer trust by providing transparent information about the sourcing and handling of meat products. Regulatory technology (RegTech) solutions are being adopted to ensure compliance with international standards, helping companies navigate complex regulatory landscapes efficiently.

The meat industry plays a pivotal role in the tourism and hospitality sector, particularly in culinary tourism, which has seen growth as travelers increasingly seek authentic and unique dining experiences. High-quality, locally sourced meat products are a key attraction in many destinations. For instance, regions known for specific types of meat, like Kobe beef in Japan or Jamón Ibérico in Spain, leverage these specialties to attract tourists. The global culinary tourism market, which is expected to grow by 9% annually, underscores the opportunity for meat producers to partner with local tourism boards and hospitality businesses to promote regional specialties that attract international visitors.

There is an emerging trend of collaboration between the meat industry and educational institutions, focusing on research and development of sustainable meat production techniques and training the next generation of agricultural professionals. Universities and vocational schools are increasingly offering programs in sustainable agriculture, animal science, and food safety, supported by industry partnerships that provide students with hands-on experience. For example, major agricultural colleges in the United States are working with meat producers to conduct research on genetic engineering and sustainable farming practices, aiming to reduce the environmental impact of meat production.

The meat industry's adoption of AI and big data is transforming various facets from production to customer engagement. AI is used for predictive maintenance in meat processing plants, improving operational efficiency by anticipating equipment failures before they occur. Data analytics are employed to analyze consumer buying patterns and preferences, allowing companies to tailor their marketing strategies more effectively. For instance, machine learning models are used to forecast demand spikes during holidays, helping producers and retailers adjust their inventory and pricing strategies. Moreover, AI-driven chatbots and virtual assistants are being deployed in customer service to provide consumers with detailed product information and personalized cooking advice, enhancing customer engagement and satisfaction.

Another interesting crossover is with the textile and fashion industry through the development of biofabricated leather. Companies like Modern Meadow are creating sustainable bio-leather materials from collagen proteins derived from yeast, which offers a high-quality leather alternative without animal welfare concerns. This innovation not only provides a sustainable alternative for fashion but also opens a new revenue stream for biotech companies engaged in the meat industry's peripheral sectors.

There's a significant link between the meat industry and environmental management through the utilization of by-products. Rendering plants convert waste products from meat processing into valuable by-products such as biofuels, animal feeds, and pharmaceutical ingredients. This not only helps in minimizing waste but also contributes to the circular economy by creating value from by-products that would otherwise be disposed of. The global market for animal by-product rendering is expected to reach $10 billion by 2025, driven by increased demand for sustainable and eco-friendly products.

Trends and developments across countries

In the United States, the meat industry is witnessing a robust expansion in the production of alternative proteins. This year, investment in plant-based meat alternatives has surpassed $1 billion, a reflection of shifting consumer preferences towards more sustainable and ethical food choices. This trend is bolstered by regulatory support, such as the USDA's updated guidelines that favor production practices reducing environmental impact, which in turn supports the growth of organic and non-GMO meat products.

Meanwhile, in Brazil, the world's largest exporter of beef, the focus has been on enhancing meat quality and export capabilities through advanced genetics and breeding technologies. The Brazilian government, in partnership with private enterprises, has launched initiatives to improve the genetic stock of the national herd, aiming to boost meat quality and disease resistance. These measures are crucial as Brazil seeks to expand its market reach in Asia, particularly China, where demand for high-quality beef continues to rise. In the first quarter of 2024 alone, Brazilian beef exports to China increased by 15%, driven by these quality improvements.

China's meat industry is undergoing significant transformation due to growing domestic demand and the government's push for food security. The Chinese government has implemented new policies to support the livestock sector, including subsidies for livestock farmers and investments in biotechnology research to increase meat production efficiency. Moreover, China is aggressively promoting the adoption of cultured meat technologies, aiming to reduce its reliance on meat imports. Chinese companies in the cultured meat sector are expected to commence commercial production by late 2025, with government backing in both funding and regulatory approvals.

In Europe, stringent EU regulations on animal welfare and antibiotic use are reshaping production practices. European meat producers are increasingly adopting animal welfare-friendly practices, such as free-range farming and enhanced living conditions, to comply with these regulations and cater to consumer demands for ethically produced meat. This shift has also spurred growth in the premium meat products market, with sales of organic and certified humane meat increasing by 20% over the past year.

India presents a contrasting scenario where the meat industry is relatively small due to cultural and religious preferences, but there is notable growth in the poultry sector. India is now among the top five poultry producers globally, with the industry growing at an annual rate of 12%. This growth is supported by technological advancements in poultry feed and health management, which have significantly increased production efficiency. Additionally, the Indian government's efforts to standardize and regulate meat processing to improve food safety are expected to further boost the industry.

In Australia, the meat industry is leveraging advanced technologies such as IoT and AI to enhance drought management strategies and improve water usage efficiency in livestock farming. These initiatives are critical as Australia often faces severe drought conditions. The Australian government has partnered with tech companies to deploy smart sensors and satellite imagery to monitor pasture health and water resources, enabling farmers to optimize their resources better and sustain production even in adverse conditions.

Japan is intensifying its focus on premium meat products with a strong emphasis on safety and traceability, which are highly valued by Japanese consumers. The Wagyu beef industry, known for its high-quality and luxury status, is employing advanced genetics and feed optimization to enhance meat quality further. Japan has also increased its reliance on technology for traceability, implementing blockchain technology to track the lineage and treatment of cattle from birth to butcher. This technology reassures consumers about the authenticity and quality of their purchases, addressing food safety concerns rigorously. The export of Wagyu beef has seen a steady increase, with a 10% growth in exports to the United States and Europe in 2024, fueled by rising global demand for premium products.

Russia has been focusing on increasing its self-sufficiency in meat production to reduce dependence on imports. This move is partly motivated by political factors, including economic sanctions. Russian meat production has grown by 5% in 2024, driven by government subsidies and investments in livestock facilities. Furthermore, Russia is exploring the expansion of halal meat production to cater to the domestic Muslim population and for export purposes, particularly targeting Middle Eastern markets where demand for halal products continues to grow.

South Africa faces unique challenges and opportunities in its meat industry. As a country plagued by high levels of income disparity, meat consumption patterns are highly variable. In response, South Africa is developing more inclusive market strategies that include offering a range of meat products that are accessible to lower-income consumers while also catering to the luxury market segment with exotic meats like game. The country is also a leader in the export of game meat, with stringent conservation and management practices that ensure sustainability.

Canada is leveraging its strong agricultural biotechnology sector to enhance meat production. Canadian researchers are leading significant breakthroughs in livestock genetics and disease resistance. Furthermore, Canada's meat industry is increasingly adopting sustainable practices, such as reduced antibiotic use and enhanced animal welfare standards, which align with the global shift towards more ethical and sustainable meat production. Canada's beef exports have increased, particularly to markets like Japan and the European Union, where there is a high demand for sustainably produced meat.

Mexico has been developing its poultry industry aggressively. As one of the largest consumers of poultry in the world, Mexico is not only working on meeting domestic demand but also on becoming a more significant player in the global poultry export market. Investments in disease management and biosecurity have been key, particularly following previous challenges with avian influenza. Enhanced production practices have enabled Mexico to increase its export capacity, with a 20% growth in poultry exports to the United States and Canada in 2024.

New Zealand has long been recognized for its high-quality lamb and beef exports, and it is capitalizing on this reputation by advancing its sustainability initiatives. Known for its clean, green image, New Zealand's meat industry is further enhancing this through investments in carbon-neutral production processes. In 2024, New Zealand launched a series of projects aimed at achieving zero-carbon meat production by 2030. These include methane-reducing livestock feeds and increased use of renewable energy sources in meat processing plants. The country's efforts are not only improving environmental outcomes but also increasing market appeal to environmentally conscious consumers globally, with exports seeing a 12% increase to European markets that highly value sustainability.

Argentina, a major beef exporter, is facing the dual challenge of maintaining production levels while addressing international concerns about deforestation linked to livestock farming. In response, Argentina is increasing its investment in regenerative agriculture techniques that enhance soil health and increase biodiversity on cattle farms. This shift is helping to preserve Argentina's beef export markets, particularly to the European Union and China, where there is growing scrutiny over environmental sustainability. Argentine beef exports have remained robust, benefiting from these sustainable farming practices that appeal to international markets.

Thailand is focusing on technology to boost its burgeoning poultry industry, which is one of the top exporters in Southeast Asia. Advanced disease surveillance systems and automated feeding technologies are improving efficiency and biosecurity, making Thai poultry products competitive in international markets. Thailand is also expanding its halal meat production to serve its Muslim population and increase exports to Middle Eastern countries, where demand for quality halal meat is high. In 2024, Thailand's poultry exports increased by 8%, driven by these technological and market diversification strategies.

Germany is at the forefront of the alternative meat sector in Europe. German startups and established companies alike are innovating in plant-based and cultured meat products. In 2024, Germany saw a 20% increase in investment in alternative meat research and development, reflecting a strong domestic and European market interest. German consumers are particularly receptive to alternative proteins due to high environmental and health consciousness, making Germany a pivotal market for these products.

India, despite its predominantly vegetarian culture, is experiencing growth in its meat industry, particularly in areas where meat consumption is culturally accepted. This growth is driven by increasing urbanization and rising incomes. The Indian government is supporting the modernization of meat processing to improve food safety standards, which historically have been a challenge. Innovations in cold chain infrastructure and the introduction of stringent quality control measures are helping India slowly transition to a more organized and efficient meat industry, targeting both domestic and export markets.

Growth and development

The meat industry's growth growth is driven by a complex interplay of global demand, technological innovation, and evolving consumer preferences. The overall global meat market is projected to grow from $1.46 trillion in 2024 to over $1.96 trillion by 2029, reflecting a growth of about 6.8%. This growth is underpinned by several key factors that highlight the dynamic evolution of the sector.

Firstly, there has been significant capital infusion into the sector, targeting both traditional meat production and alternative proteins. The investments are not just enhancing production capacities but also fueling research and development in biotechnologies, which are crucial for future growth. For instance, in the cultured meat segment, which is still nascent but rapidly growing, production costs have plummeted by over 80% since 2019. This segment alone attracted over $500 million in venture capital in 2024, demonstrating the market's confidence in its commercial viability.

Technological advancements across the meat supply chain are catalyzing this growth. Precision agriculture and livestock farming are becoming more prevalent, utilizing sensors, AI, and big data to optimize everything from feed management to animal health, reducing waste and improving productivity. For example, smart farming technologies have enabled a 10% increase in feed efficiency, which directly enhances profitability by lowering operational costs.

Another significant driver is the expanding global middle class, particularly in Asia-Pacific regions, which has led to increased meat consumption. As income levels rise, dietary patterns shift towards higher protein intake, bolstering meat demand. China and India, for instance, have seen annual increases in meat consumption of 5% and 6%, respectively. This demographic and economic shift is prompting meat producers to scale operations and explore new markets to meet the surging demand.

Additionally, sustainability initiatives are playing a critical role in the industry’s development. Consumer demand for sustainable and ethically produced meat is rising, pressuring producers to adopt more environmentally friendly practices. This has spurred innovations such as methane-reducing livestock feeds and more sustainable packaging solutions, which not only help mitigate the environmental impact but also align with consumer expectations and regulatory standards.

The regulatory environment too is influencing industry growth, particularly in developed markets where animal welfare and environmental impact are heavily legislated. In the European Union, stringent regulations regarding animal welfare and antibiotic use are pushing producers to adopt more humane and sustainable production methods. Compliance with these regulations is not merely a legal obligation but a competitive advantage in markets where consumers are particularly sensitive to these issues.

The diversification of product offerings in the meat sector is also indicative of its growth. Beyond traditional cuts of meat, there is increasing market penetration of value-added products, such as ready-to-cook and ready-to-eat meats, which cater to the fast-paced lifestyle of modern consumers. The value-added segment is growing at a CAGR of 8%, significantly faster than the overall meat industry, highlighting changing consumer behavior and the industry's adaptive strategies.

Best practices

One significant best practice is the integration of vertical operations that streamline the entire value chain from feed production to retail distribution. By controlling more aspects of the supply chain, companies can ensure quality at every stage, reduce costs, and respond more dynamically to market shifts. For example, major companies like Tyson Foods have implemented full vertical integration by owning feed mills, hatcheries, processing plants, and distribution networks. This control over the entire process allows them to ensure consistent product quality and significantly mitigate risks associated with external suppliers and market volatility.

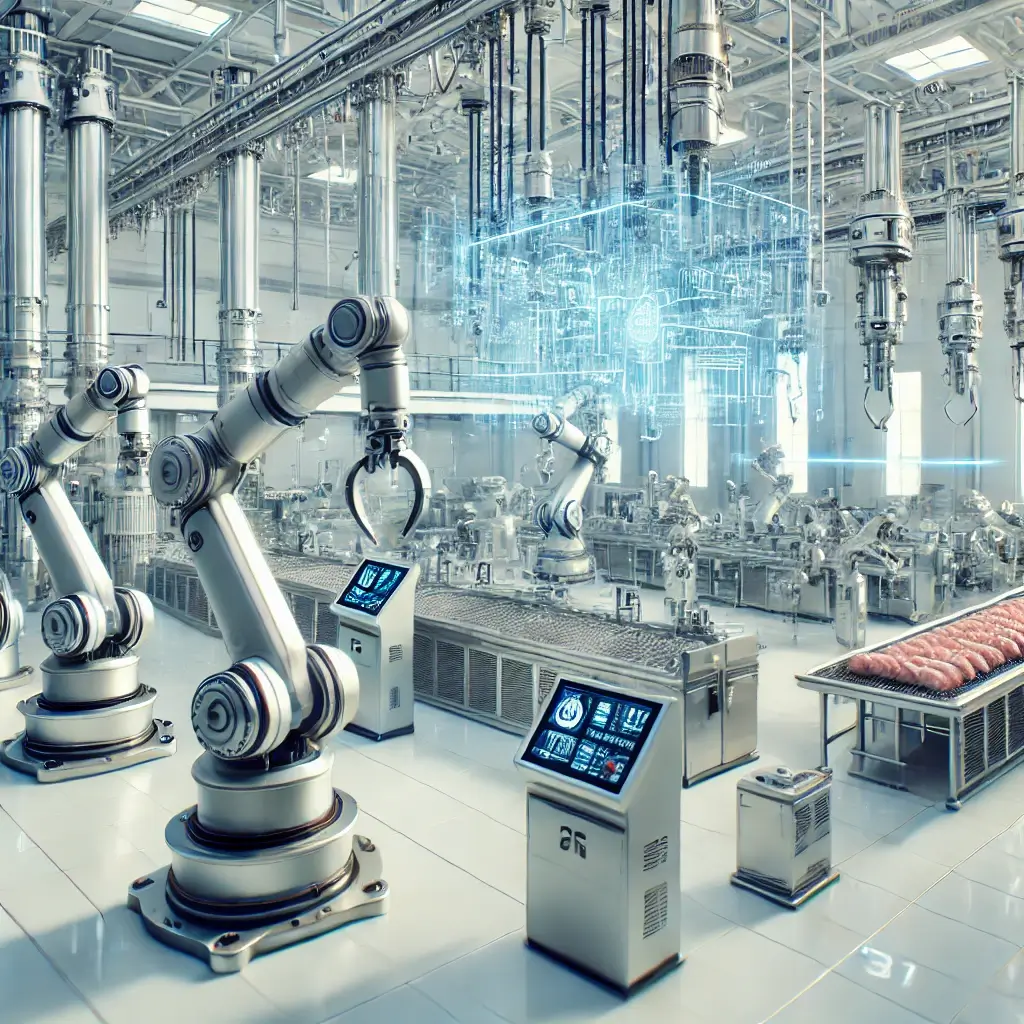

Moreover, automation and robotics have become central to the operations of top meat producers. In processing plants, automation technologies handle tasks ranging from butchering to packaging, which not only speeds up the production process but also improves safety and reduces contamination risks. The use of robotics has led to a 20% increase in processing efficiency, according to data from 2024, while also reducing labor costs and human error. Advanced imaging and cutting technologies ensure precise cuts, maximizing yield and reducing waste.

Sustainability is another critical focus area, with top players investing heavily in renewable energy, waste reduction, and innovative farming techniques. Companies are increasingly adopting methane-reduction strategies, such as feed additives that inhibit methane production in ruminants, and are investing in manure management systems that convert waste into energy. For instance, Smithfield Foods has installed biogas capture systems across most of its farms, which not only help reduce greenhouse gas emissions but also generate renewable energy. These practices not only help companies meet regulatory requirements but also resonate with the growing consumer demand for environmentally responsible products.

The application of genetic technologies to improve livestock health and productivity is also a method adopted by industry leaders. Through genetic selection and CRISPR technology, companies have been able to breed animals that are more resistant to diseases, have better feed conversion ratios, and produce higher-quality meat. This not only enhances animal welfare by reducing disease prevalence but also aligns with consumer concerns about antibiotic use in livestock.

In terms of marketing and consumer engagement, top meat producers are leveraging data analytics to understand consumer preferences and tailor their products accordingly. They utilize consumer data to forecast trends, optimize product mixes, and develop marketing strategies that resonate with specific demographics. Additionally, many are enhancing transparency by implementing traceability systems using blockchain technology, which allows consumers to trace the product back to its source, providing information about the animal's upbringing, feed, and processing. This level of transparency is becoming a significant differentiator in the marketplace.

In response to the global shift towards plant-based diets, many traditional meat companies are diversifying their portfolios to include plant-based and cultured meat options. This not only caters to a broader range of dietary preferences but also positions these companies as forward-thinking and adaptable to global food trends.

Risks and pain points

One of the most pressing issues is the environmental impact of meat production, which is increasingly under scrutiny. The livestock sector is one of the significant contributors to global greenhouse gas emissions, accounting for approximately 14.5% of all anthropogenic emissions according to the FAO. This environmental footprint has led to regulatory pressures for more sustainable practices. Companies are required to invest in cleaner, more sustainable technologies, which often entail high upfront costs and complex implementation.

Economically, the volatility of feed prices remains a substantial risk. Feed constitutes up to 70% of the livestock production costs. Fluctuations in the price of soybeans and corn can dramatically affect profitability. In 2024, the U.S. faced a 5% increase in feed costs due to unfavorable weather conditions affecting crop yields. Such volatility makes financial planning challenging and can squeeze margins, particularly for smaller producers who might not have the capital reserves of larger corporations.

On the operational front, the spread of animal diseases poses a significant risk, impacting productivity and trade. African Swine Fever continues to be a concern, especially in Asia where it has led to the culling of millions of pigs since its outbreak. The economic impact is profound; for instance, China, which accounts for half of the world’s pork consumption, saw a reduction in pork production by approximately 20% in 2023 due to ASF, impacting global pork prices and supply chains.

Regulatory challenges also loom large. The meat industry is highly regulated in aspects such as food safety, animal welfare, and environmental compliance. In Europe, the regulatory environment is particularly stringent, with laws mandating detailed tracking and reporting of antibiotic use in livestock. Compliance requires significant investment in monitoring and reporting systems, and non-compliance can lead to hefty fines or restrictions on operations.

Furthermore, labor shortages are a critical operational challenge. Meat processing is labor-intensive, and plants often rely on migrant labor, which can be unstable due to political and immigration policy changes. For example, shifts in immigration policy in the United States under previous administrations led to a shortage of workers in meat processing plants, forcing some plants to reduce capacity.

Consumer shifts pose another significant challenge. There is a growing trend towards plant-based diets, driven by health, environmental, and ethical concerns. In 2024, sales of plant-based meat alternatives in the U.S. grew by 15%, reflecting this shift. Traditional meat producers must adapt to these changes by diversifying their product ranges or enhancing the sustainability credentials of their products to maintain market share.

The risk of supply chain disruptions, exacerbated by global crises such as pandemics or geopolitical tensions, remains a perennial challenge. The COVID-19 pandemic demonstrated the vulnerabilities in the meat supply chain, with several plants having to shut down due to outbreaks among workers, leading to meat shortages and spiking prices.

Mitigating solutions

To address the environmental impact of meat production, one of the key strategies has been the adoption of advanced agricultural practices that reduce the carbon footprint. Technologies such as precision farming, which uses GPS and IoT sensors, are being applied to optimize feed usage and monitor livestock health more accurately, thereby reducing waste and improving efficiency. For instance, precision feeding systems have helped reduce feed waste by up to 20% in some large-scale operations, contributing to lower greenhouse gas emissions.

Financial risks associated with the volatility of feed prices are being mitigated through the use of financial hedging instruments. Large producers are leveraging futures contracts and options to lock in prices for key commodities like corn and soybeans, which constitute the primary feed ingredients. This approach provides a buffer against price fluctuations that can impact profitability. Furthermore, some companies are diversifying their feed sources and investing in the development of alternative feeds, such as algae-based feeds, which are less susceptible to the market fluctuations typical of traditional crops.

The threat of animal diseases, which can decimate livestock populations and disrupt supply chains, is being combated through enhanced biosecurity measures. Implementing strict on-farm biosecurity protocols and investing in health monitoring technologies are crucial. For example, the deployment of wearable technology for livestock that monitors vital signs and detects early symptoms of illness is gaining traction. This technology not only helps in early disease detection and containment but also reduces the spread of infections, thereby minimizing economic losses.

Labor shortages, particularly in meat processing plants, are a significant operational challenge. To combat this, the industry is increasing automation within processing facilities. Robotic butchers and automated packaging lines are becoming more common, reducing the reliance on human labor and increasing efficiency. These automated systems can handle tasks from cutting and deboning to packaging, operating around the clock without fatigue, thus maintaining consistent productivity levels.

Regulatory challenges are addressed through proactive engagement with policymakers and continuous compliance efforts. Many companies are investing in compliance management systems that help track and manage regulatory requirements more effectively. Additionally, there is a growing trend of voluntary third-party certifications for animal welfare and environmental management, which not only ensure compliance but also enhance brand reputation among consumers.

Supply chain disruptions, highlighted by recent global events like the COVID-19 pandemic, have underscored the need for more resilient supply chains. Companies are diversifying their supplier bases and increasing inventory buffers to handle disruptions more effectively. Moreover, integrating blockchain technology to enhance traceability and transparency throughout the supply chain has proven effective. This technology enables companies to quickly trace contamination sources or disruptions and respond swiftly, thereby minimizing impact.

Consumer shifts towards plant-based diets are prompting traditional meat producers to diversify their product portfolios to include plant-based and cultured meat alternatives. Investment in research and development for these products is increasing, with several traditional meat companies either launching their own brands or forming partnerships with startups in the alternative protein space.

Future outlook

The future of the industry reflects a landscape of evolving tech, shifting consumer preferences, and increasing regulatory pressures that are driving significant transformation across the sector. As we look toward 2025 and beyond, several key developments are expected to shape the industry.

One of the most transformative trends is the continued rise of alternative proteins, including plant-based and cultured meat products. The global market for alternative proteins is projected to exceed $290 billion by 2035, capturing a substantial share of the protein market. This growth is driven by consumer demand for more sustainable and ethical food options. Traditional meat companies are responding by either developing their own plant-based products or through acquisitions and partnerships in the alternative protein sector. For instance, major players like JBS and Tyson Foods have established dedicated units for producing plant-based products, signaling a strategic diversification in response to market demands.

Technological innovation remains at the forefront of the meat industry’s evolution. Advances in biotechnology are making cultured meat more cost-effective and scalable. Recent breakthroughs in cellular agriculture have reduced the cost of cultured meat to near parity with premium conventional meats as of 2024, and this trend is expected to continue, enhancing its market viability. Moreover, the integration of AI and machine learning in production processes is optimizing everything from feed formulation to disease prevention, thereby enhancing productivity and sustainability.

Environmental sustainability will continue to be a critical focus. The industry is under pressure to reduce its carbon footprint and improve resource efficiency. Innovations such as methane-reducing feed additives are becoming more widespread, and renewable energy adoption in processing plants is growing. These changes are not only driven by regulatory requirements but also by consumer expectations for environmentally responsible practices.

The global meat market is also likely to see increased volatility due to climate change, which affects feed crop yields and water availability, impacting production costs and supply stability. Companies are therefore investing in more resilient agricultural practices and exploring new feed sources that are less susceptible to climate variabilities.

Regulatory environments are tightening, with more countries likely to introduce stringent regulations on animal welfare, antibiotic use, and environmental impact. These regulations will drive further changes in industry practices, potentially increasing operational costs but also improving the standard and quality of products available to consumers.

Consumer trends towards health and transparency will drive the demand for meat products that are not only produced responsibly but also offer enhanced nutritional benefits. Traceability will be a key factor, with technologies like blockchain gaining prominence, allowing consumers to verify the origins and handling of their food.

As the global demographic landscape changes, with population growth strongest in regions like Asia and Africa, the meat industry will need to address the logistical and ethical challenges of meeting increased demand from these regions. This will likely involve both expanding local production capabilities and increasing imports, which in turn will require navigating complex trade relationships and local consumer preferences.

Recommendations to companies

To navigate the complex landscape of the meat industry, companies need to adopt strategic measures that address both current and future challenges while seizing opportunities for growth and innovation. Adopting and advancing technological integration is paramount. Companies should invest significantly in digital technologies like blockchain for enhancing traceability, which not only improves supply chain management but also caters to the growing consumer demand for transparency. For example, employing blockchain can help verify the authenticity and quality of meat products, providing a competitive edge in markets where food safety concerns are paramount.

Building robust partnerships and collaborations is also essential, especially in areas like research and development for alternative proteins. Collaborating with startups and academic institutions can accelerate innovation, particularly in developing plant-based and cultured meat products. This approach allows traditional meat companies to diversify their portfolios more efficiently and tap into new consumer segments. For instance, strategic partnerships with biotech firms have enabled some meat companies to enhance their product offerings with fortified meats that meet specific dietary needs, thus appealing to health-conscious consumers.

Investing in sustainable practices is another critical recommendation. Companies should look beyond compliance and actively contribute to sustainable development goals, such as reducing water usage and incorporating sustainable packaging solutions. This could involve investing in water recycling systems and adopting biodegradable packaging materials, which not only helps in reducing the environmental impact but also enhances brand loyalty among environmentally conscious consumers.

To ringfence against the risk associated with volatile feed costs, companies should explore vertical integration strategies or develop alternative feed solutions that are less susceptible to market fluctuations. For instance, using by-products from other industries as feed or investing in the development of synthetic feeds could provide cost stability and reduce dependency on traditional feedstocks like corn and soybean, whose prices are highly volatile.

Moreover, workforce management is crucial, particularly in addressing labor shortages and enhancing worker safety, which is a significant concern in meat processing facilities. Implementing automated meat processing systems can reduce reliance on manual labor and minimize the risk of workplace injuries. These systems also increase processing efficiency and consistency in product quality.

Lastly, proactive regulatory engagement is vital. Staying ahead of regulatory changes by participating in policy discussions and industry forums can provide insights into future regulatory trends and allow companies to adjust their operational and strategic plans accordingly. This proactive approach can also facilitate a smoother adaptation to new regulations, avoiding potential disruptions and ensuring compliance.

As the meat industry approaches the horizon of profound transformation, it stands at a critical juncture that is set to redefine its future role within the global economic landscape and the daily lives of billions of consumers. The intricate interplay of advancing technologies, evolving consumer demands, and intensifying regulatory frameworks has set the stage for a seismic shift in how meat is produced, consumed, and perceived worldwide.

The industry's journey towards sustainability and innovation is not merely a response to market pressures; it is a forward-looking movement aimed at reconciling the demands of a growing global population with the imperative to preserve our environmental resources and uphold ethical standards. This evolution presents a tapestry of challenges and opportunities—each thread representing potential paths that could lead to revolutionary changes in food security, ecological conservation, and economic growth.

In this transformative era, the choices made by industry leaders, policymakers, and consumers will collectively shape the trajectory of the meat sector. These decisions will determine the sustainability of meat production techniques, the viability of alternative proteins, and the ethical considerations of animal welfare. The impact of these decisions will ripple through ecosystems and economies, influencing everything from small-scale agriculture to international trade policies.

As we contemplate the future of the meat industry, it is clear that the stakes are exceedingly high. The sector's ability to adapt and innovate will not only redefine its own identity but also play a crucial role in addressing some of the most pressing challenges of our time, including climate change, ethical food production, and global health. The path forward is fraught with complexity, but it is also laden with opportunities for significant positive impact.

This pivotal moment in the meat industry is more than a phase of adaptation; it is a profound opportunity for reinvention. Stakeholders across the spectrum—from farmers and corporations to consumers and governments—are called to participate in shaping a sustainable, equitable, and prosperous future. The actions we take today will resonate through generations, crafting a legacy of our environmental stewardship, our commitment to ethical practices, and our vision for a nourished and sustainable world. As the narrative of the meat industry unfolds, it promises to be a compelling saga of innovation, challenge, and hope—a narrative that we all have a stake in shaping.

Yaman believes in reshaping larger organizations for which he

is known to associate with. He has a trustworthy reputation for finding

solutions when no one can and be at the frontline before the issue is even

thought of. He believes in strengthening the core of services through teamwork

and unity while connecting the dots for what might be the only way forward in

this day and age.

In this thought provoking piece, we delve into the transformative trends reshaping the meat industry, highlighted by the adoption of sustainable practices, technological advancements, and shifting consumer preferences. The piece emphasizes the crucial need for strategic adaptation and innovation among meat producers to address the dual challenges of environmental sustainability and changing market demands. As a global enabler and management consulting firm, Hylman is ideally positioned to support companies in navigating this complex landscape. Hylman's expertise in strategic planning, technological integration, and sustainability initiatives makes it an invaluable partner for companies seeking to capitalize on emerging opportunities and drive forward-thinking solutions in the meat industry.